[ad_1]

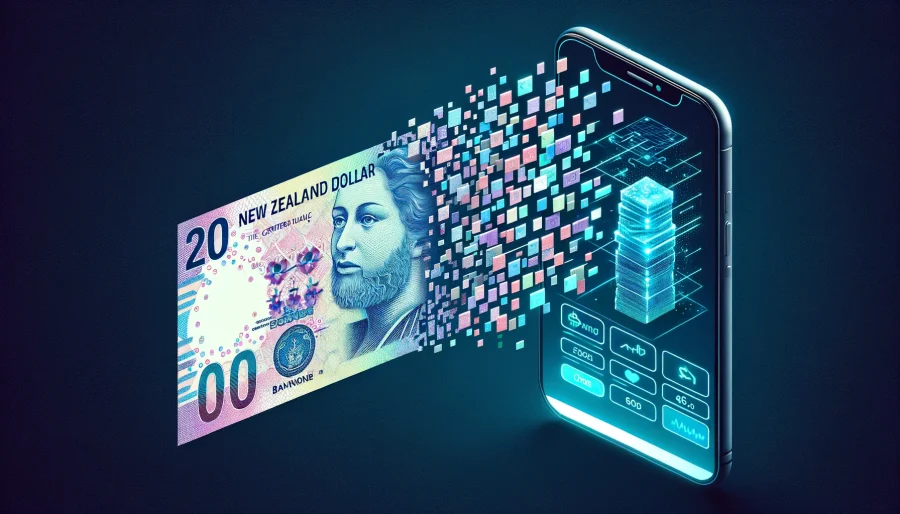

The Reserve Financial institution of New Zealand (RBNZ) has introduced that it’s exploring the introduction of a central financial institution digital forex (CBDC), also known as “digital money.” This transfer comes because the RBNZ goals to deal with the challenges posed by improvements in cash and funds to New Zealand’s financial sovereignty.

In response to Ian Woolford, the RBNZ’s director of cash and money, the digital money would coexist with bodily money choices and wouldn’t require a business checking account for utilization. As a substitute, customers would solely want a digital pockets, cost card, or cellular app. Woolford claimed that the digital money would improve privateness, safety, and belief for customers, and famous that the central financial institution “won’t management or see the way you spend your cash.” Woolford additionally defined that it might work offline:

It might additionally work through Bluetooth, so you may make funds with out connecting to web. This could be helpful in an emergency, or when the ability is out.

The RBNZ has launched a session interval, which can final till July 26, 2024, to collect public enter on the high-level design of the digital money. This marks the preliminary section of a multi-stage exploration course of that’s anticipated to increase till roughly 2030, with ongoing alternatives for public engagement.

The choice to discover a CBDC follows feedback made by Adrian Orr, the governor of the Reserve Financial institution of New Zealand, who has been essential of stablecoins. Orr has described stablecoins as “the largest misnomers” and “oxymorons,” expressing skepticism about their capacity to switch conventional forex and their inherent instability.

The RBNZ’s exploration of a CBDC aligns with a rising international pattern, as central banks world wide are investigating the potential advantages and challenges of issuing their very own digital currencies. Because the monetary panorama continues to evolve, the RBNZ’s transfer to discover a CBDC underscores its dedication to sustaining New Zealand’s financial sovereignty and making certain the resilience of its monetary system.

What’s a CBDC?

A CBDC is a digital type of a conventional forex, issued and backed by the central financial institution. Not like cryptocurrencies, that are decentralized and never managed by any central authority, a CBDC is a centralized digital forex that’s absolutely built-in with the normal monetary system.

The important thing options of a CBDC embody its digital type, issuance and management by the central financial institution, authorized tender standing, centralized management, and potential to enhance monetary inclusion. The first objectives of a CBDC are to modernize the monetary system, improve cost effectivity, enhance monetary inclusion, and preserve the central financial institution’s management over financial coverage within the face of challenges posed by new digital cost applied sciences.

The introduction of a CBDC is being thought of or actively labored on by nations together with the UK, China and the European Union.

[ad_2]

Supply hyperlink