[ad_1]

The cryptocurrency market has witnessed a major surge after a chronic bear market and the intensified crypto winter attributable to the collapse of crypto exchanges and companies throughout 2022 and a part of 2023.

Notably, Bitcoin and different main cryptocurrencies have skilled substantial value surges, accompanied by renewed curiosity from institutional traders coming into the market by not too long ago accepted spot Bitcoin exchange-traded funds (ETFs).

Including to the business’s optimistic outlook, asset supervisor and Bitcoin ETF issuer, Grayscale, believes that the present state of the market signifies that the business is within the “center” levels of a crypto bull run.

Grayscale not too long ago launched a complete report detailing their key findings and insights into what lies forward. A more in-depth evaluation of the report by market professional Miles Deutscher sheds mild on the components contributing to this evaluation.

On-Chain Metrics And Institutional Demand

Grayscale’s report begins by highlighting a number of key alerts indicating that the market is presently in the course of a bull run. These embody Bitcoin’s value surpassing its all-time excessive earlier than the Halving occasion, the full crypto market cap reaching its earlier peak, and the rising consideration from conventional finance (TradFi) in direction of meme cash.

To know how lengthy this rally may maintain, Grayscale emphasizes two particular value drivers: spot Bitcoin ETF inflows and robust on-chain fundamentals.

Grayscale notes that almost $12 billion has flowed into Bitcoin ETFs in simply three months, indicating important “pent-up” retail demand. Furthermore, ETF inflows have constantly exceeded BTC issuance, creating upward value strain because of the demand-supply imbalance.

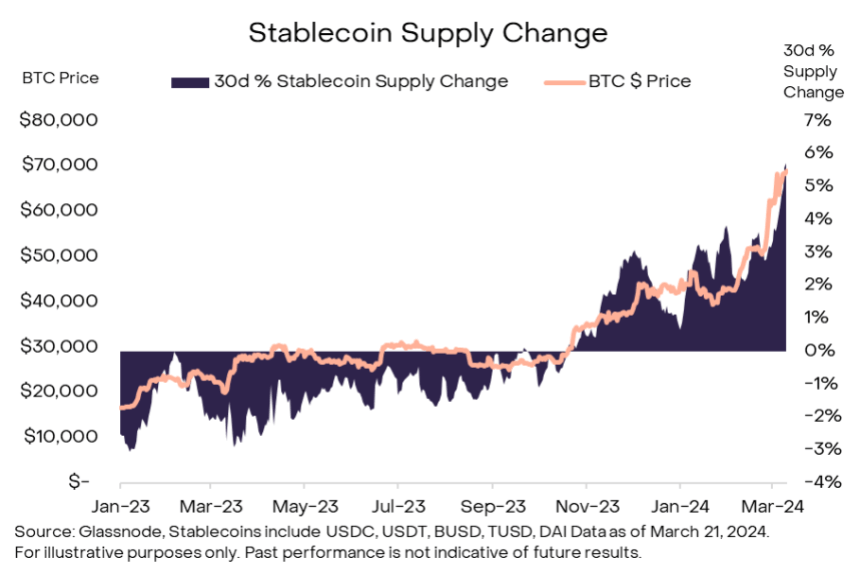

Grayscale’s analysis focuses on three important on-chain metrics: stablecoin inflows, decentralized finance (DeFi) complete worth locked (TVL), and BTC outflows from exchanges.

In response to Deutscher, the rise in stablecoin provide on centralized exchanges (CEXs) and decentralized exchanges (DEXs) by roughly 6% between February and March suggests enhanced liquidity, making extra capital available for buying and selling.

Moreover, for the analyst, the doubling of the full worth locked into DeFi since 2023 represents rising consumer engagement, elevated liquidity, and improved consumer expertise inside the DeFi ecosystem.

The outflows from exchanges, which presently account for about 12% of BTC’s circulating provide (the bottom in 5 years), point out rising investor confidence in BTC’s worth and a choice for holding slightly than promoting.

Primarily based on these catalysts, Grayscale asserts that the market is within the “mid-phase” of the bull run, likening it to the “fifth inning” in baseball.

Promising Outlook For Crypto Trade

A number of key metrics assist Grayscale’s evaluation, together with the Web Unrealized Revenue/Loss (NUPL) ratio, which signifies that traders who purchased BTC at decrease costs proceed to carry regardless of rising costs.

In response to Deutscher, the Market Worth Realized Worth (MVRV) Z-Rating, presently at 3, implies that there’s nonetheless room for progress on this cycle. Moreover, the ColinTalksCrypto Bitcoin Bull Run Index (CBBI), which integrates a number of ratios, presently stands at 79/100, suggesting that the market is approaching historic cycle peaks with some upward momentum remaining.

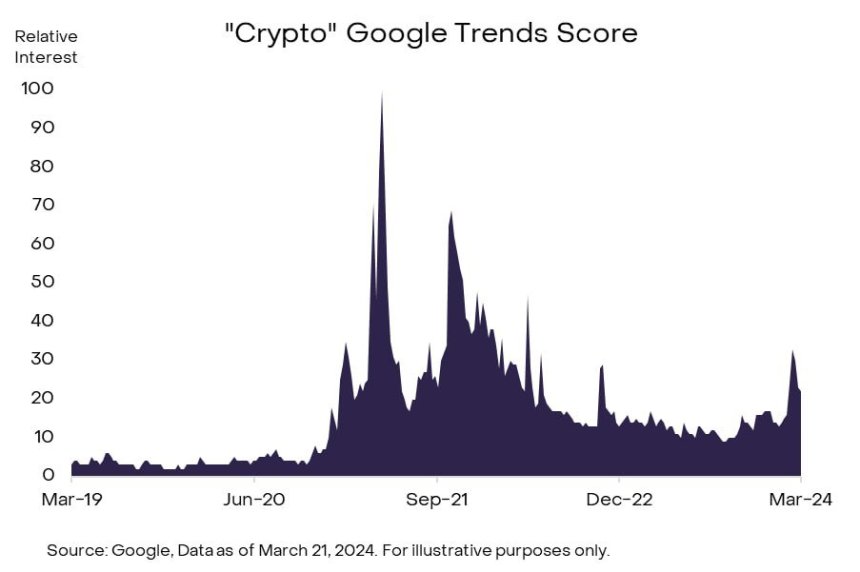

Moreover, retail curiosity has but to totally return this cycle, as evidenced by decrease cryptocurrency YouTube subscription charges and diminished Google Tendencies curiosity for “crypto” in comparison with the earlier cycle.

In the end, Grayscale retains a “cautiously optimistic” stance concerning the way forward for this bull cycle, given the promising alerts and evaluation outlined of their report.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site fully at your individual threat.

[ad_2]

Supply hyperlink