[ad_1]

In accordance with an ET report, this plan, which was placed on maintain for a 12 months, may quickly come into impact.The Reserve Financial institution of India (RBI) is working carefully with banks to make sure a clean transition. The transfer goals to control abroad bank card transactions inside the present remittance limits.

New LRS guidelines for Worldwide Credit score Card Spending:

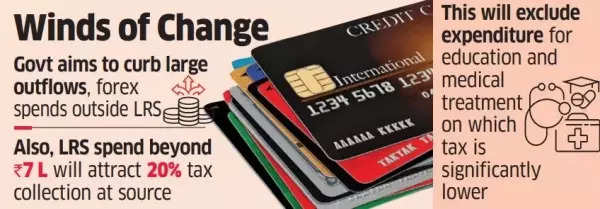

- Underneath the proposed adjustments, worldwide bank card bills incurred whereas touring overseas can be counted in direction of the annual cap of $250,000 allowed for remittances below the LRS.

- Moreover, any spending past Rs 7 lakh will entice a 20%

tax assortment at supply (TCS), with sure exceptions for training and medical functions the place the taxes are a lot decrease. People could also be eligible for a tax refund if the TCS quantity exceeds their whole tax legal responsibility.

The brand new rules are seen as a part of the federal government’s broader technique to curb extreme overseas alternate outflows and prohibit high-value expenditures made by worldwide bank cards. Nonetheless, banks are searching for readability on the best way to differentiate between private and enterprise bills, in addition to between abroad card utilization and on-line transactions made in India for companies like lodge bookings.

New worldwide bank card guidelines

Business consultants recommend the necessity for a extra nuanced method. “Within the period of ease of doing enterprise, the place the federal government’s purpose is to encourage manufacturing in India and promote export of products, a broader mindset is required in controlling overseas alternate outflow fairly than limiting spending by bank cards,” Siddharth Banwat, CA and co-founder at Yuvyze Consulting LLP was quoted as saying.

In accordance with him, making a separate restrict for overseas alternate spending by way of bank cards, along with the prevailing remittance cap might assist. This, he says, would streamline the reporting course of and remove the necessity for TCS on bank card transactions inside the LRS limits.

There are challenges forward, notably in imposing the segregation of expenditures. Excessive net-worth people (HNIs) might discover various strategies to bypass these restrictions, resembling using unofficial channels or partaking in reciprocal preparations with acquaintances. The current price range amendments associated to TCS on LRS funds and abroad excursions have prompted a reassessment of bank card rules. Whereas the federal government initially deliberate to implement these adjustments earlier, the shortage of preparedness amongst banks and card networks led to a delay of their enforcement.

Because the deadline approaches, banks are working diligently to align their techniques with the brand new pointers to make sure a seamless transition for patrons.

[ad_2]

Supply hyperlink