[ad_1]

Unveiling the Thriller:

Utilizing Fibonacci Tubes for Strategic Foreign exchange Trades

The Fibonacci sequence, a mathematical sample discovered all through nature, has captivated mathematicians and merchants for hundreds of years. On this planet of foreign currency trading, Fibonacci tubes supply a singular software to establish potential help and resistance zones, worth retracements, and even revenue targets.

Fibonacci tubes, an extension of the favored Fibonacci retracement software, supply a singular lens to establish potential worth motion within the foreign exchange market. They leverage the mathematical fantastic thing about the Fibonacci sequence, believed to carry a pure order inside monetary markets.

Whereas not a foolproof system, Fibonacci ranges, when used strategically, can improve your understanding of potential help and resistance zones, including one other layer to your buying and selling toolbox.

Decoding the Fibonacci Tube:

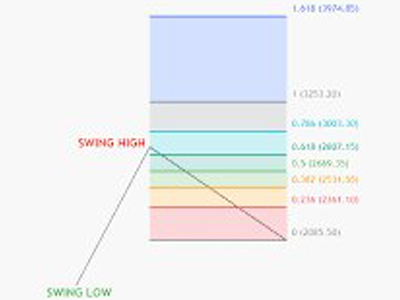

Think about a sequence of horizontal strains drawn throughout a worth chart, emanating from a big swing excessive and low. These strains, adjusted primarily based on Fibonacci ratios (like 38.2%, 50%, 61.8%, and 78.6%), create channels that act as potential worth magnets.

The facility of every degree stems from the Fibonacci sequence’s inherent relationship to market psychology. Merchants, consciously or unconsciously, usually acknowledge these ratios as areas of potential worth reversal or continuation.

The Energy of Every Stage:

- 38.2% & 50%: These shallower retracement zones are widespread pausing factors throughout a longtime development. A worth that finds help at these ranges usually indicators continuation of the development.

- 61.8%: This degree holds immense significance. A worth reversal at 61.8% suggests a stronger counter-trend transfer. It usually coincides with current help or resistance ranges, strengthening its potential for a turnaround.

- 78.6%: A deeper retracement, a worth reversal right here signifies a probably important development shift. It’s essential to substantiate this reversal with different technical indicators to keep away from false indicators.

Bear in mind: These are potential worth zones, not ensures. Markets are dynamic, and different components can affect worth motion.

Ideas for Using Fibonacci Tubes Successfully

It’s All About Affirmation:

- Value Candlesticks: Search for bullish reversal patterns like pin bars or engulfing bars at help ranges, or bearish reversal patterns like taking pictures stars or double tops at resistance zones throughout the tubes.

- Transferring Averages: A worth bouncing off a key Fibonacci degree that additionally coincides with a transferring common can strengthen the help/resistance sign.

- Affirmation is Key: Value conduct at Fibonacci tube ranges is just not a assure. At all times use extra technical indicators or elementary evaluation to substantiate potential trades.

- Market Dynamics Rule: Foreign exchange is a dynamic market. Fibonacci tubes supply insights, not ensures. Value motion could be influenced by unexpected occasions.

- Handle Threat Correctly: At all times follow correct danger administration methods like stop-loss orders to restrict potential losses.(Use tubes mixed with earlier resistances to handle your value and cease loss.)

- Follow Makes Excellent: As with all buying and selling software, grasp the usage of Fibonacci tubes via follow on demo accounts earlier than risking actual capital.

Past Value Ranges: Harmonic Patterns

Fibonacci ranges prolong their affect past fundamental help and resistance. When mixed with harmonic worth patterns (like Gartley, Bat, or Butterfly patterns), they create highly effective buying and selling alternatives. These patterns incorporate Fibonacci ratios into their formation, and their confluence with Fibonacci tube ranges provides important weight to potential worth actions.

Bear in mind: Fibonacci ranges are a probabilistic software, rising the probabilities of figuring out potential turning factors. They don’t assure a reversal, however they’ll flag areas the place worth motion could hesitate, retrace, or reverse, permitting you to make knowledgeable buying and selling choices.

Conclusion

Fibonacci ranges are a beneficial software for foreign exchange merchants. By understanding the significance of every degree and its potential affect on worth actions, you may make knowledgeable buying and selling choices. Bear in mind, Fibonacci ranges are one piece of the puzzle. Mix them with different technical evaluation and a strong danger administration technique to navigate the ever-evolving foreign exchange market.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. Please seek the advice of with a certified monetary advisor earlier than making any funding choices.

Blissful buying and selling

could the pips be ever in your favor!

[ad_2]

Supply hyperlink