[ad_1]

KEY

TAKEAWAYS

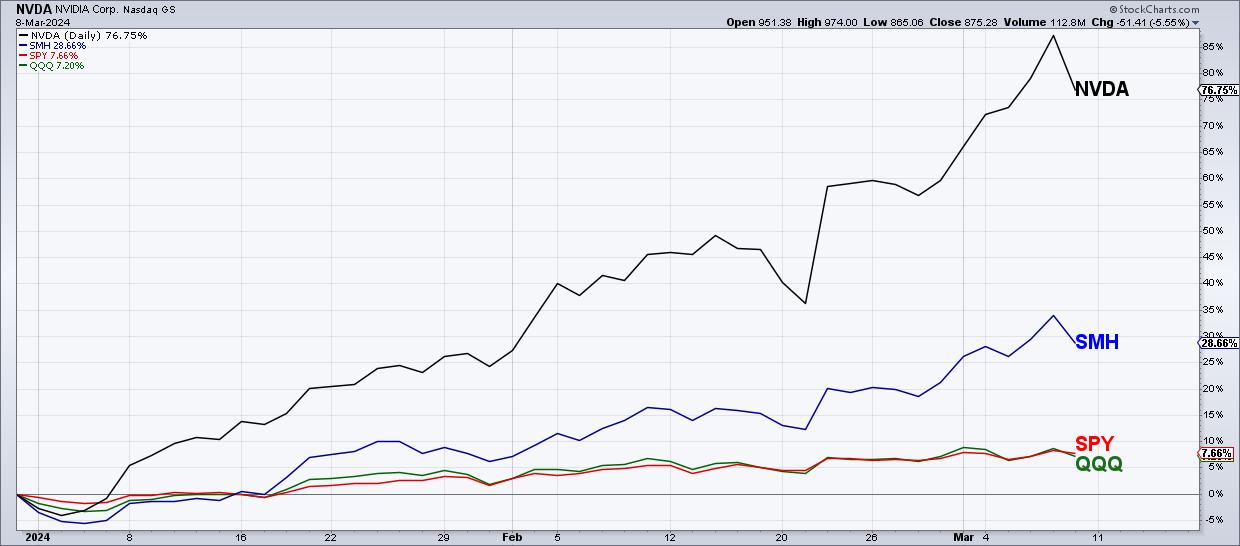

- Nvidia is up 77% year-to-date, far outpacing the S&P 500 and Nasdaq that are each up about 7-8%.

- A bearish engulfing sample is a two-bar candle sample indicating short-term distribution and destructive sentiment.

- Draw back targets for NVDA could be recognized utilizing trendlines and Fibonacci retracements.

Massive-cap development shares have been outperforming for fairly a while, with semiconductors maybe probably the most consultant of the power of that commerce in latest months. The truth is, the semiconductor ETF (SMH) completed the week up 29% year-to-date, far outpacing the S&P 500 and Nasdaq 100, that are each up about 7.5% in 2024.

Nvidia (NVDA) has been maybe probably the most overheated of the Magnificent 7 shares, gaining over 87% in 2024 by means of Thursday’s shut. Friday, nonetheless, noticed NVDA open increased and shut decrease, creating the dreaded bearish engulfing sample. Does this imply the highest is in for Nvidia?

Let’s begin by reviewing the long-term pattern going into this week, which has been nothing in need of distinctive. After breaking above resistance round $500 in early January, Nvidia launched into a constant uptrend of upper highs and better lows. NVDA nearly doubled in worth by means of this week, reaching an intraday excessive of $974 on Friday. However the decrease shut is what actually tells the story right here.

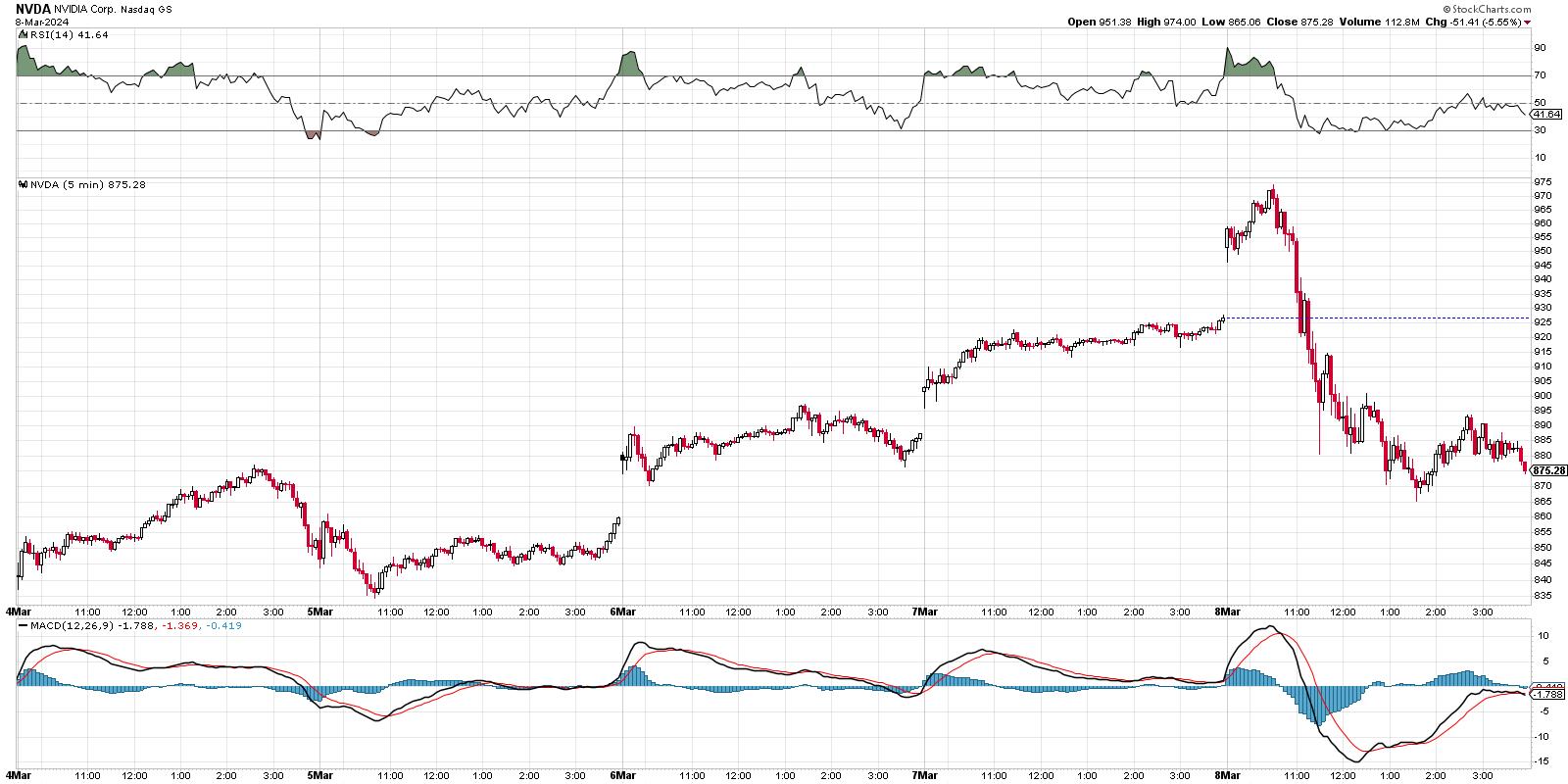

A bearish engulfing sample is a basic two-bar reversal sample the place an up shut, if adopted by a down shut, and day two’s actual physique “engulfs” the vary of day one’s actual physique. The intraday chart for these two days reveals how the short-term worth motion demonstrates a real reversal in sentiment.

Now we’re seeing this week’s worth motion utilizing 5-minute candles. Notice how Thursday’s rally continued the upward trajectory that basically started on Tuesday going into the shut. Friday noticed an enormous hole increased on the open, however, after an preliminary rally, NVDA turned decrease and continued this pullback into the afternoon. By the shut, Nvidia completed properly under Thursday’s buying and selling vary, creating the bearish engulfing sample.

The excellent news is about two-bar candle patterns is that they supply a built-in threat administration system! Steve Nison is mostly credited with bringing candlestick charting, a standard Japanese type of technical evaluation, and selling its deserves to Western technical analysts. I spoke with Steve years in the past about reversal patterns, and he famous that the excessive of the two-bar bearish engulfing sample can be utilized as a easy stop-loss approach.

So, if NVDA would push above the $975 degree subsequent week, primarily based on Friday’s intraday excessive, that might negate the reversal sample and counsel additional upside potential. In any other case, the bearish implication of this sample stays in place, and means that semiconductors could also be in for a pullback as we proceed by means of the month of March.

Writer’s observe: I’ve set a worth alert for NVDA breaking above $975 utilizing the Technical Alert Workbench, and I would encourage you to do the identical!

If we assume that “the highest” is in, a minimum of for now, then how can we establish some potential draw back targets for Nvidia?

A trendline primarily based on the key lows in 2024 yields a draw back goal round $760-775, relying on how rapidly a pullback would happen. This could additionally line up pretty properly with Nvidia’s most up-to-date swing low, round $775. If this degree would fail to carry, I would key in on the 200-day transferring common, which at the moment sits round $660.

A fast Fibonacci evaluation would counsel an preliminary draw back goal round $750, which might symbolize a 38.2% retracement of the October 2023 low to the latest excessive round $975. The 200-day transferring common additionally strains up properly with the 50% retracement degree round $682, giving further emphasis to this as a possible draw back assist degree.

As I discussed at the start of this text, I’d think about charts like Nvidia to be harmless till confirmed responsible. This implies an uptrend is in place so long as we proceed to look at a sample of upper highs and better lows. However, by noticing a bearish engulfing sample on NVDA, in addition to on the S&P 500 and Nasdaq 100, we are able to anticipate how short-term worth reversals may certainly manifest into broader declines that would catch buyers without warning!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any manner symbolize the views or opinions of every other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers reduce behavioral biases by means of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor determination making in his weblog, The Aware Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing threat by means of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to establish funding alternatives and enrich relationships between advisors and shoppers.

Be taught Extra

[ad_2]

Supply hyperlink