[ad_1]

Notice to the reader: That is the tenth in a collection of articles I am publishing right here taken from my e-book, “Investing with the Pattern.” Hopefully, you will discover this content material helpful. Market myths are usually perpetuated by repetition, deceptive symbolic connections, and the whole ignorance of information. The world of finance is stuffed with such tendencies, and right here, you may see some examples. Please understand that not all of those examples are completely deceptive — they’re typically legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are immediately associated to investing and finance. Take pleasure in! – Greg

Secular Markets

For years (many years), analysts referred to long-term market cycles as generational markets. Ed Easterling has now outlined them for us utilizing a spinoff methodology. Beforehand, most simply regarded on the value motion and when it rose, referred to as it a bull market, and when it declined or was flat, referred to as it a bear market. I’ll persist with Easterling’s course of, because it comes with numerous sound evaluation and that removes the subjectivity.

Secular market cycles are long-term and have averaged about 25 years over the previous 112 years. Secular bear markets common about 11.25 years in size over this era. Consider, nonetheless, there are numerous cyclical bull and bear markets throughout the longer-term secular bear markets. As a result of I comply with the evaluation of Ed Easterling of Crestmont Analysis, right here is my assessment of his e-book Possible Outcomes, revealed in 2011. This e-book, like his earlier e-book Surprising Returns, is a must-read to know how long-term markets work.

Ed Easterling has carried out it once more; offered a giant image strategy to the market utilizing time-tested historic information and sound ideas. Ed’s first e-book, Surprising Returns, was the primary time I had heard of the way in which secular markets had been outlined — by valuations. Possible Outcomes expands and updates the primary e-book. Easterling builds a technique that’s strong and clearly void of preconceived notions concerning the future; a refreshing strategy not often seen in books concerning the inventory market.

The primary a part of the e-book is a lesson in market finance and economics from a practitioner view and never the standard monetary tutorial strategy — once more fairly informative and refreshing. Each idea is supported by information and colourful charts, which make studying and understanding the method pleasing. He spends an excessive amount of effort and time to make sure that his explanations are simply understood and succinct. Secular markets are pushed by long-term developments in Value Earnings ratios (PE), which, in flip, are pushed by inflation/deflation. This removes the size of time from the secular cycle definition and solely makes use of the developments and cycles of PE and inflation because the identification of secular bear, and bear market cycle beginnings and endings. Merely, a secular bear begins when valuations peak and reverse due to a pattern again towards low inflation, then proceed to say no all through the secular interval. As soon as sufficiently low, normally single digit PE, a brand new secular bull interval can start.

The e-book wraps up with an intensive analysis of how the present decade (2010–2019) might presumably play out (at present in a secular bear), utilizing numerous completely different EPS, PE, and Inflation mixture eventualities. The message is obvious, there are occasions (secular bears) that one wants to vary their perspective on investing and search an strategy that at a minimal preserves capital in order that when the following secular bull market begins, time will not be spent making an attempt to recuperate from the previous secular bear. It’s unhappy that most individuals spend a big a part of their investing time making an attempt to recuperate from earlier losses. Understanding the secular strategy and making the change in your investing type (rowing vs. crusing) can result in a protracted retirement accompanied by dignity and luxury.

I did have one query for Ed that considerably bothered me. He was gracious sufficient to supply a superb response.

My Query: With the common secular cycle being about 25 years and the whole database being 112 years, do you are feeling there’s sufficient information to be completely assured along with your secular market evaluation?

Ed’s Reply: “Completely. However let’s step again for a second to contemplate the 2 sorts of cycles. You have got requested an amazing query, as a result of its reply reveals lots about secular inventory market cycles.

“There are two sorts of cycles: technical cycles and basic cycles. Technical cycles usually mirror patterns or ranges which have a excessive propensity to repeat. Technical cycles acquire their credibility and validity from a excessive diploma of repeating incidences. The 4 full secular inventory market cycles would hardly be thought-about excessive repetition. However secular inventory market cycles should not technical cycles.

“Secular inventory market cycles are fundamentally-driven cycles. By fundamentally-driven, I imply that financial and inflation components trigger the cycles to happen. Secular inventory market cycles are greater than patterns, they’re reactions to onerous drivers. Secular bulls and secular bears are pushed by the pattern and degree of the inflation fee. Secular cycles are the changes to monetary worth which are attributable to modifications within the inflation fee. Since will increase and reduces within the inflation fee change the anticipated fee of return, shares and bonds improve or lower in general worth and thereby add or detract from complete return.

“Take a look at the secular bear market of the Nineteen Sixties and Nineteen Seventies. Rising inflation brought on the valuation of shares to say no. The market’s value/earnings ratio declined from greater than 20 to lower than 10 over 16 years. Earnings grew and buyers acquired dividends, however the decline in valuation brought on returns to be well-below common. Then because the inflation fee turned and declined, the Nineteen Eighties and Nineties secular bull skilled the good thing about rising valuations in addition to earnings progress and dividends.

“Okay, one final remark about secular cycles. There’s one other issue apart from inflation that impacts them. The second issue is money circulate. The secular bear of 1929 was attributable to deflation. Deflation causes the nominal money flows from earnings and dividends to say no in quantity. So though the low cost fee stays low as inflation neared zero and fell into deflation, the anticipated future decline in reported money flows because of deflation brought on the current worth of the market to say no. P/E fell from greater than 20 to lower than 10. That is doubtlessly instructive concerning the future, as a result of current developments in financial progress counsel that it might be slowing from the historic fee averaging 3 p.c annual actual progress. If financial progress slows, then future earnings progress will gradual, too. Consequently, the slower progress of money flows will drive a decrease valuation for the market. Development fee impacts the extent of P/E.

“So we’ve got basic ideas associated to the ideas of money circulate and current worth. Then we’ve got 4 full-cycle examples which are in step with the well-accepted tutorial and business ideas. Is 4 full cycles sufficient to be assured concerning the idea of secular inventory market cycles? Completely!”

Thanks Ed.

Easterling factors out that these secular durations should not random as they comply with one another; he really calls them cycles. The motive force of those cycles is the inflation fee because it strikes towards and away from value stability. Tendencies of rising inflation and deflation drive the market valuation decrease and end in low returns. As costs stabilize from both deflation or excessive inflation, valuations are pushed upward and the result’s excessive returns. Remember that it is a course of whereby strikes away from value stability concurrently trigger PE to say no and low or no returns end result. Strikes towards value stability concurrently trigger PE to rise and end in excessive returns.

Moreover, the connection amongst inflation, earnings, and costs is neatly tied collectively. The S&P 500 is an index of capitalization weighted costs of 500 large-cap, blue chip shares. Inflation is the annual fee of change of the buyer value index, which is a measure of assorted costs for items and providers. Valuations (earnings) are measured relative to cost with the price-to-earnings ratio (PE). As soon as once more, technical evaluation arises as a result of all three measures used to outline secular markets are finally based mostly on value.

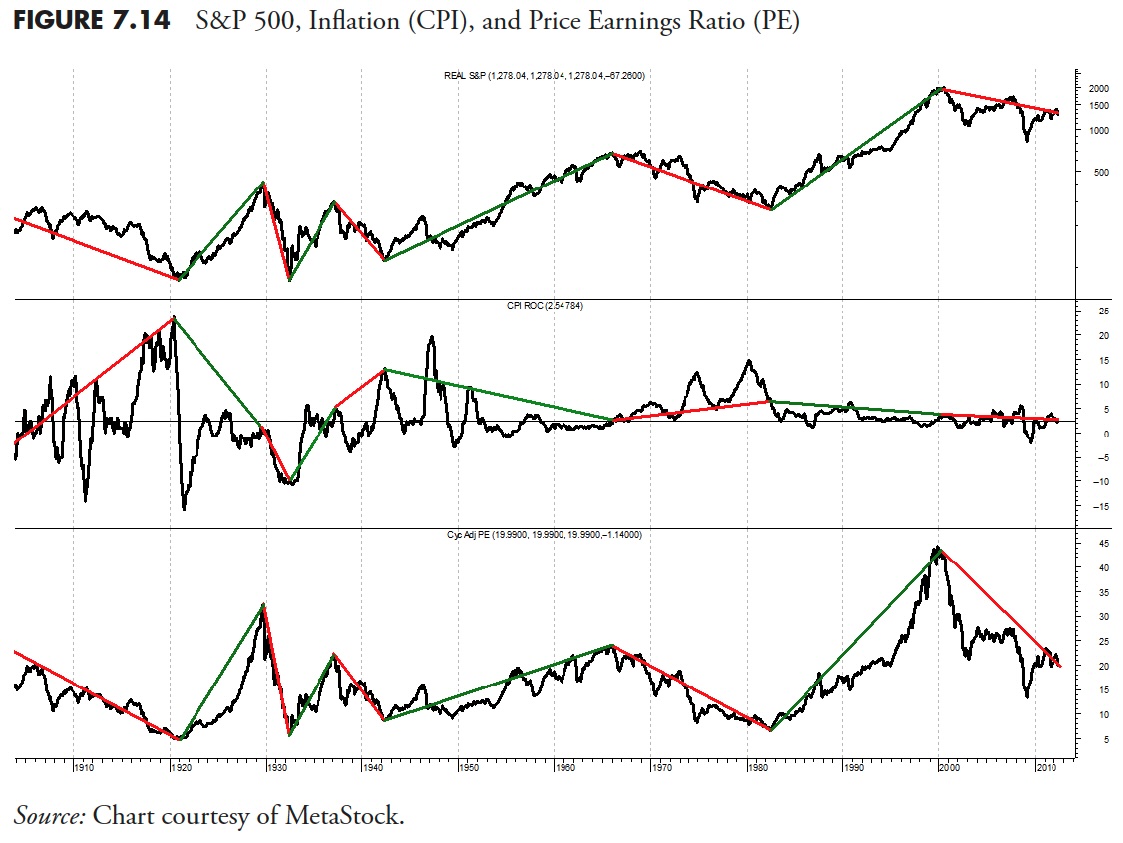

Determine 7.14 exhibits the month-to-month S&P 500 again to 1900, together with the 12-month fee of change of the Client Value Index (Inflation) and the S&P 500 PE Ratio on the backside; each the costs and the PE ratio are adjusted for inflation (often called actual). This makes the PE swings extra readily identifiable. You’ll be able to clearly see from this chart the numerous strikes in PE (backside plot) and examine to the strikes within the S&P 500 (prime plot). The upward strikes within the PE Ratio are the secular bulls and the downward strikes are the secular bears. The center plot of inflation exhibits the way it impacts valuations over time. Though the particular modifications in inflation should not aligned with the peaks and troughs of value or valuation, it’s cheap to imagine it leads them. It does seem that, when inflation is throughout the +2.5% and -1% vary (small horizontal traces), its impact will not be as nice or as well timed, and is normally through the Secular Bull markets. I believe, from this chart, the truth that secular markets are outlined by long-term swings in valuations, that are finally affected by inflation, bears (sic) out.

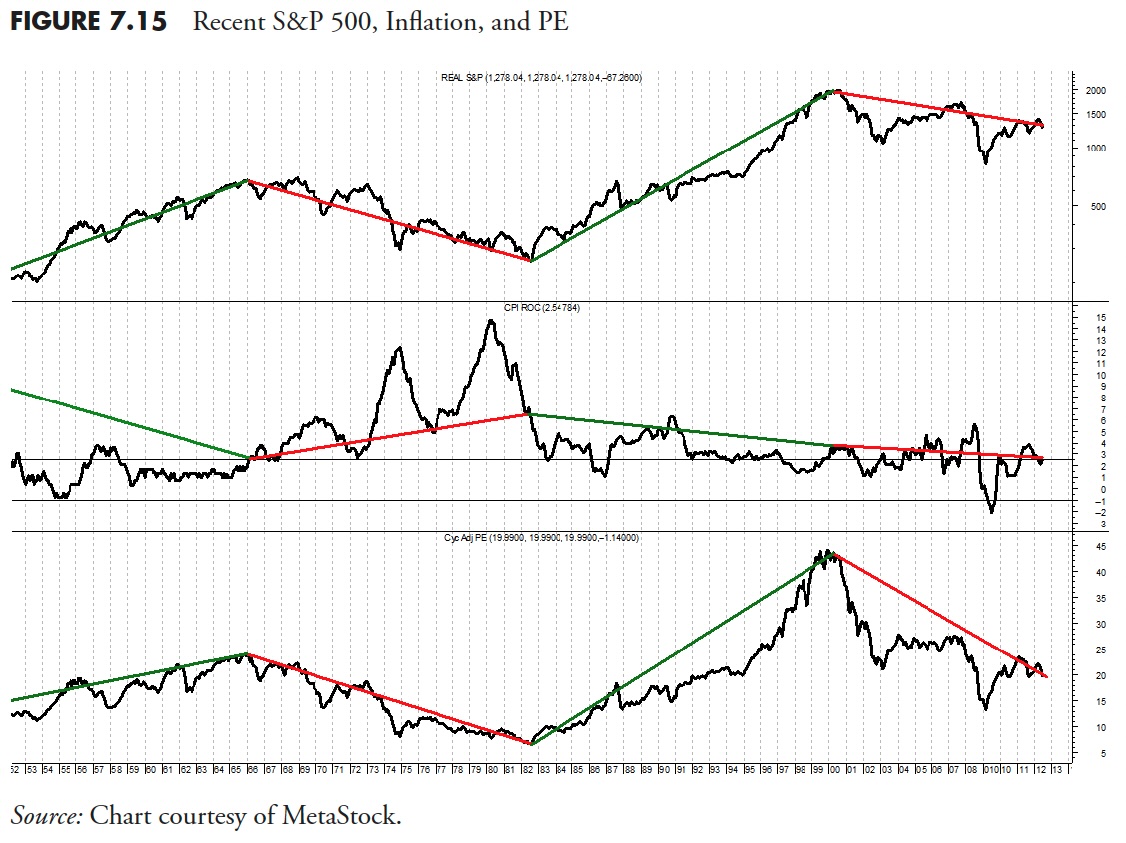

Determine 7.15 exhibits the very same information because the earlier however over a shorter time interval so you’ll be able to see the modifications higher. This chart exhibits the information since World Struggle II. The readability of the secular bull markets and bear markets within the prime plot is apparent. The modifications in general inflation within the center plot, whereas not as effectively outlined, nonetheless exist, and the underside plot exhibits the rise and fall of the worth earnings ratio along with the opposite two.

Secular Bull Markets

Don’t confuse brains with a bull market.

Do not mistake a bull marketplace for funding talent.

Martin Pring (strategist for Pring Turner Enterprise Cycle ETF [DBIZ]), describes them thusly:

“Main pattern modifications in secular (and cyclical) bull markets are normally brief and shallow and every peak is increased than its predecessor. Traders are routinely assisted from their dangerous funding selections by the bull market. Traders’ confidence grows considerably throughout these instances and finally turns into extreme, with the interval from 1998 to 1999, often called the dotcom bubble, being a basic instance. There are geniuses all over the place, and they’re paraded hourly on monetary tv. Funding selections which are thought-about irresponsible and careless initially of secular bulls are hailed as completely routine because the secular bull matures. The teachings realized within the earlier bear market are lengthy forgotten and sometimes you hear “this time is completely different.” When the vast majority of the above develop into frequent, the tip of the secular bull might be close to, regardless of prognostications that it’ll go a lot, a lot increased.”

These prognostications are given with excessive willpower and confidence. In a secular bull, one should buy and maintain, put money into index funds, greenback value common, absolutely anything. Right here is the issue: most won’t notice they’re in a secular bull market till it’s nearly over.

Secular Bull Markets since 1900

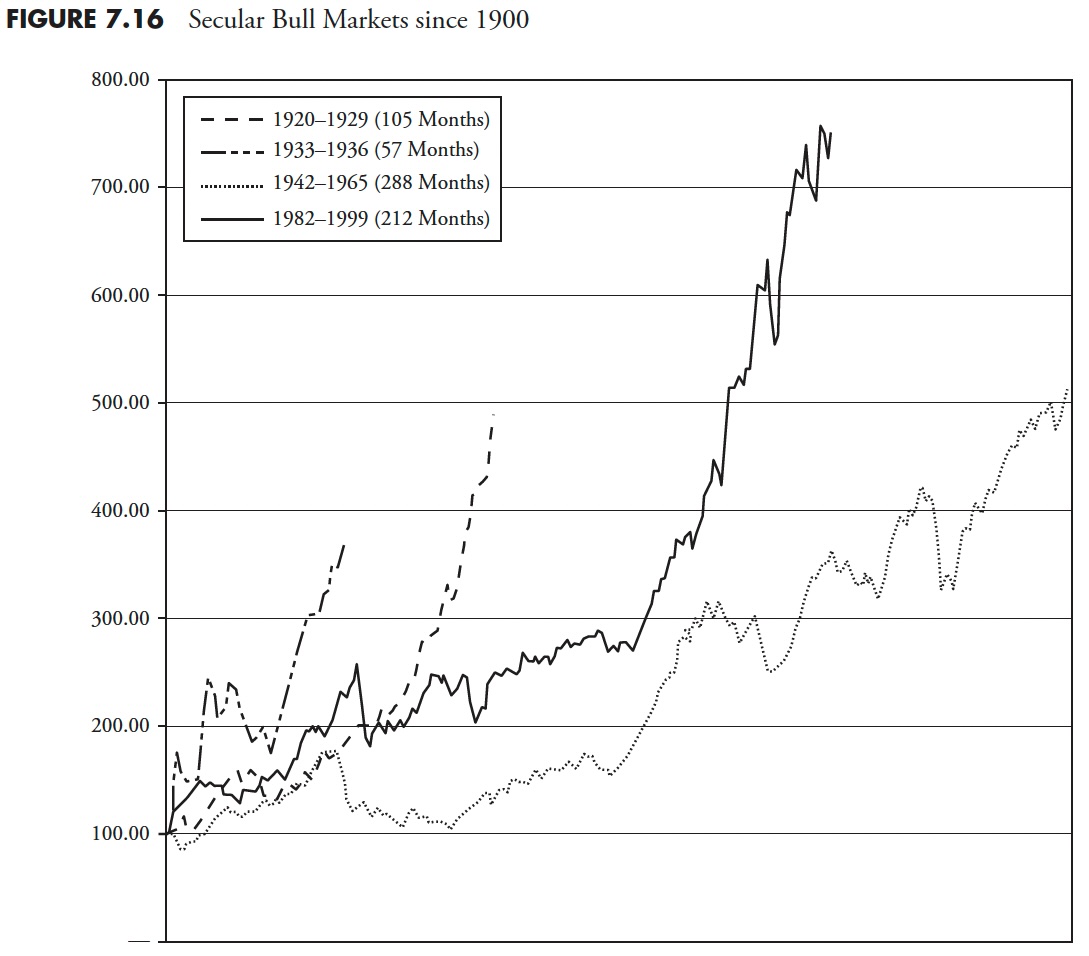

Determine 7.16 exhibits the 4 secular bull markets since 1900. It must be clear {that a} secular bull is a time when warning goes out the window. Sadly, most won’t notice it till towards the tip.

Secular Bull Information

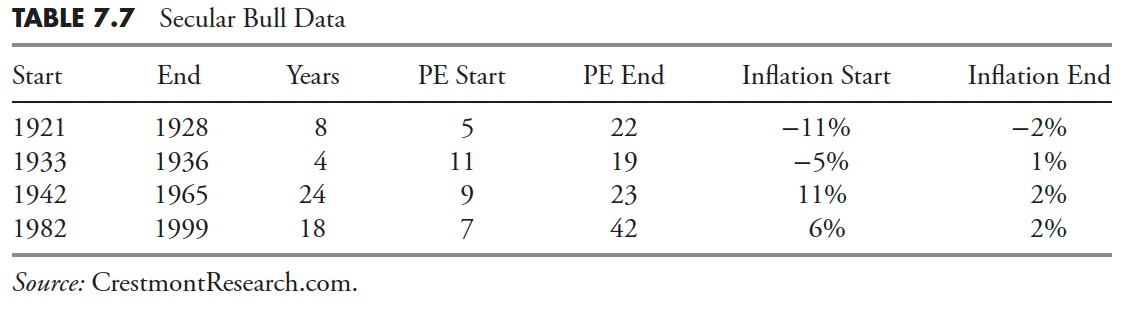

In Desk 7.7, discover that all the Secular Bull markets began when PE was between 5 and 11, and ended when PE was between 19 and 42. There are charts within the subsequent chapter that present the secular modifications in valuation.

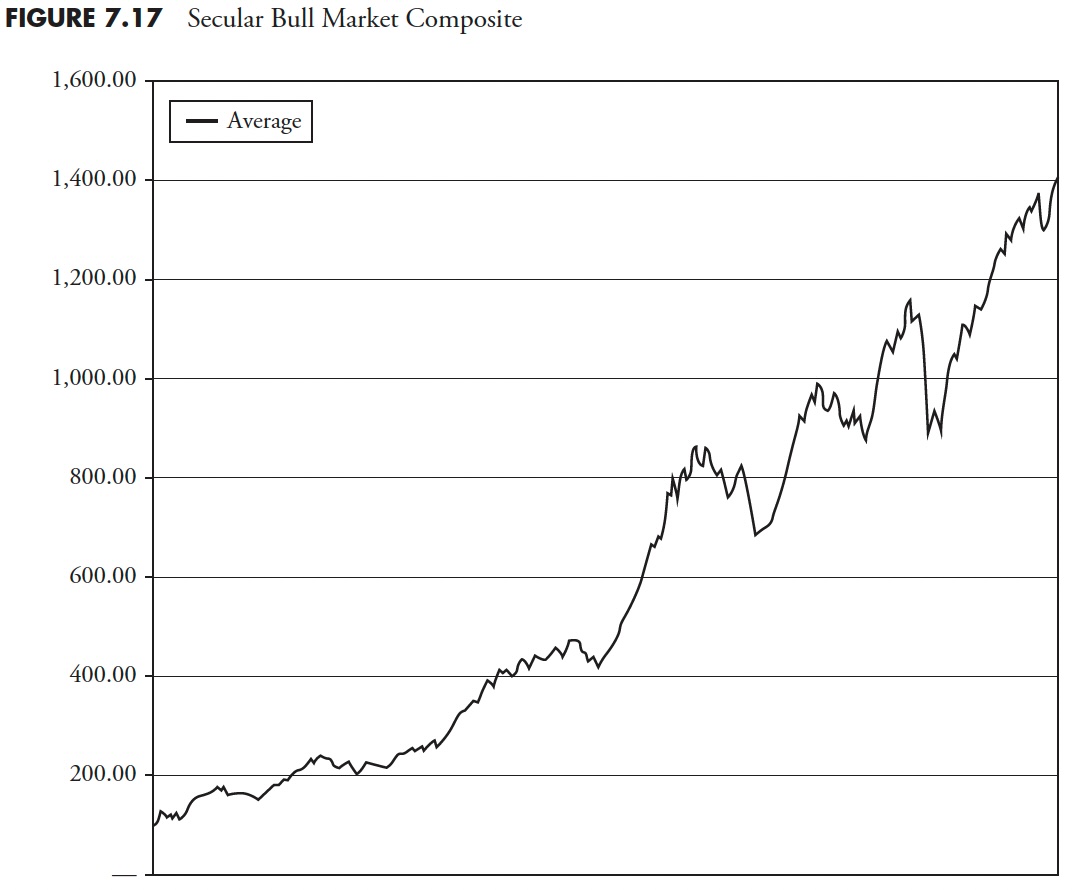

Secular Bull Market Composite

The secular bull composite is proven in Determine 7.17 . Secular bull markets, if and when you already know you might be in a single, can simply justify a few of the funding methods that this e-book considers as dangerous methods for many buyers. In fact, most won’t notice they’re in a secular bull till it’s effectively developed.

Secular Bear Markets

Martin Pring says, “the secular bears are primarily the alternative of the bulls as, on the whole, the peaks are decrease and the troughs are decrease, exhibiting a downward pattern. Nevertheless, understand that they don’t seem to be at all times down-trending, and there’s typically a brand new excessive within the center. The important thing traits are declining value earnings ratio (PE) and low or no returns. Identical to the secular bull, each lesson realized is shortly forgotten. Identical to a recession cleanses the economic system, the secular bear resets all the things and removes all of the excesses. Most secular bulls finish and secular bears start with out there being a situation of extra. The excessive valuation of the market is the rational results of low inflation.

“Actually there are moments of extra, simply as regular market volatility creates brief durations of extra and the alternative of extra. My key level is that secular tops and bottoms are the results of basic circumstances fairly than irrational feelings. The bearish prognosticators are as soon as once more the day by day media darlings. And as soon as once more, identical to within the secular bull, the forecasts are for complete gloom and doom. The willpower and confidence of those forecasters is convincing, but finally unsuitable.

“Right here is one thing that’s essential to recollect: Secular bear markets account for over 50% of the whole time. In truth, as of 2012, there have been really extra years in secular bears than in secular bulls since 1900. The earlier two factors are true however understand that the interval being noticed has a secular bear at each ends. Since bears should not essentially longer than bulls, and vice versa, it is cheap to say that they’re about the identical in size on common, however the vary of phrases varies considerably. Secular bear markets trigger buyers to hunt various investments or unconstrained investments that shield them from draw back losses. Nevertheless, identical to the secular bull, most shall be in denial and never take part within the secular bear correctly till sustained losses, after which it can in all probability be about over.”

The following part exhibits graphics of the varied secular bear markets. They had been created with month-to-month information for the S&P 500 from Robert Shiller’s database. If yearly information had been used, the message could be primarily the identical.

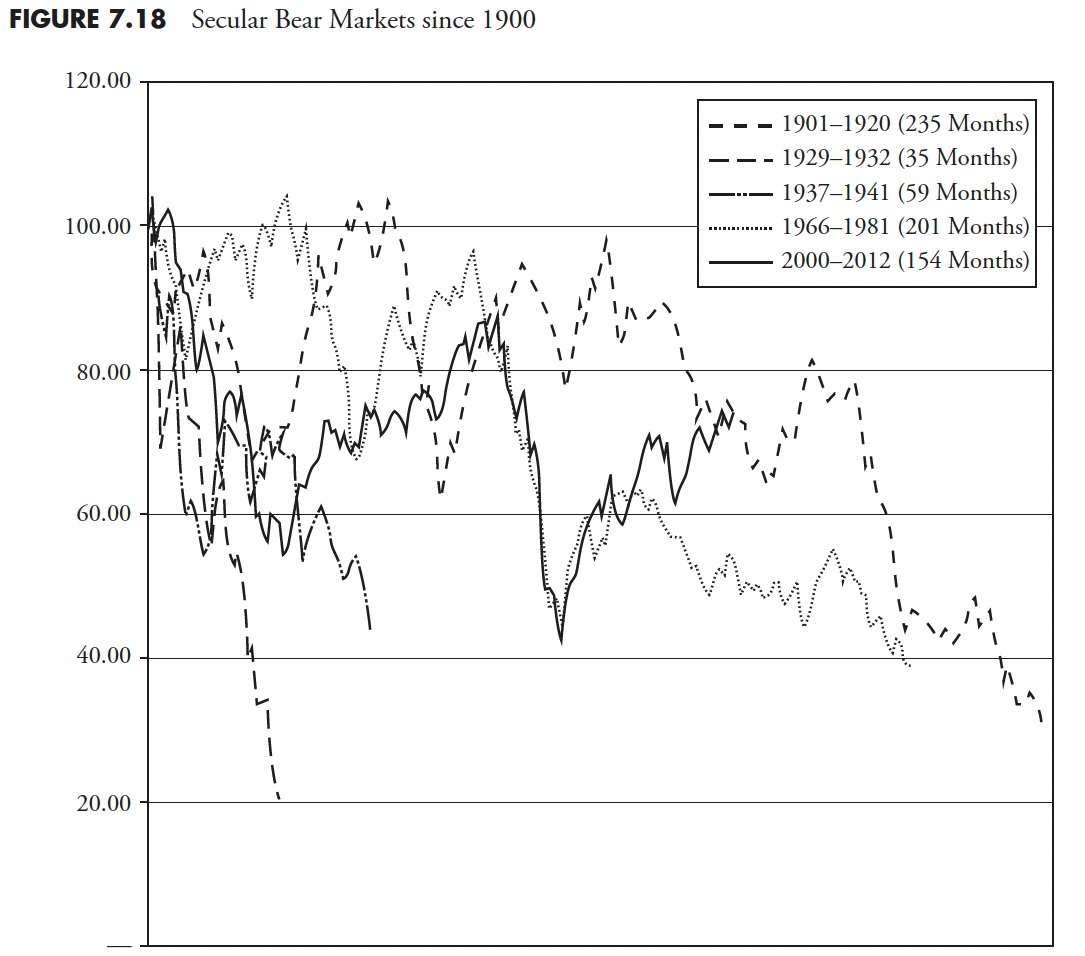

Secular Bear Markets since 1900

Determine 7.18 exhibits all 4 of the earlier inflation-adjusted secular bear markets, together with the present one from their start line on the left aspect of the graph. Two of the secular bears had been shorter, and two had been longer, than the one which started in 2000. One can not make an funding resolution with this info — solely an consciousness that we’re at present in a secular bear market (as of 12/31/2012) and it might final for much longer.

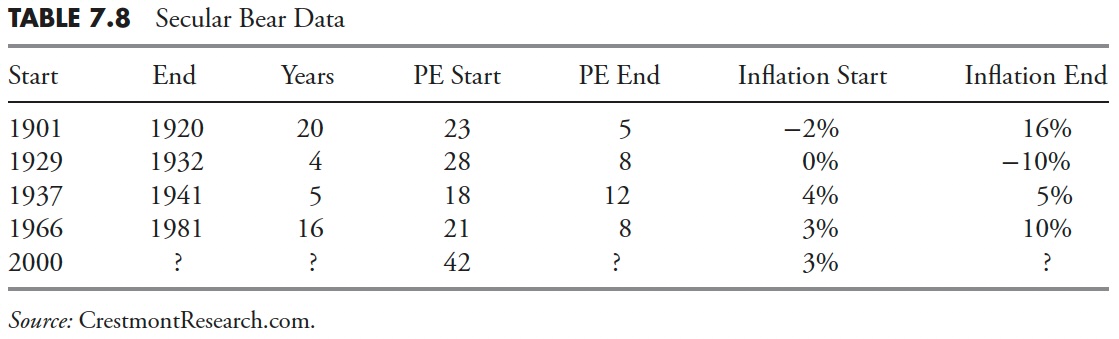

Secular Bear Information

Ed Easterling says that secular markets are decided by long-term swings in valuations which are pushed by inflation. From Desk 7.8, you’ll be able to see that the Nice Despair secular bear didn’t contain an increase in inflation, nevertheless it additionally solely lasted three years. As of this writing (2013), the secular bear that started in 2000 remains to be in progress.

Discover that the Secular Bear markets began when their PE was between 18 and 42, and ended when their PE was between 5 and 12. The beginning PE for the primary 4 Secular Bears was between 18 and 28. The Secular Bear that started in 2000 began at 42, which is an outlier for a beginning PE. The following chapter exhibits charts just like the secular charts displaying the modifications in valuations over the varied secular cycles.

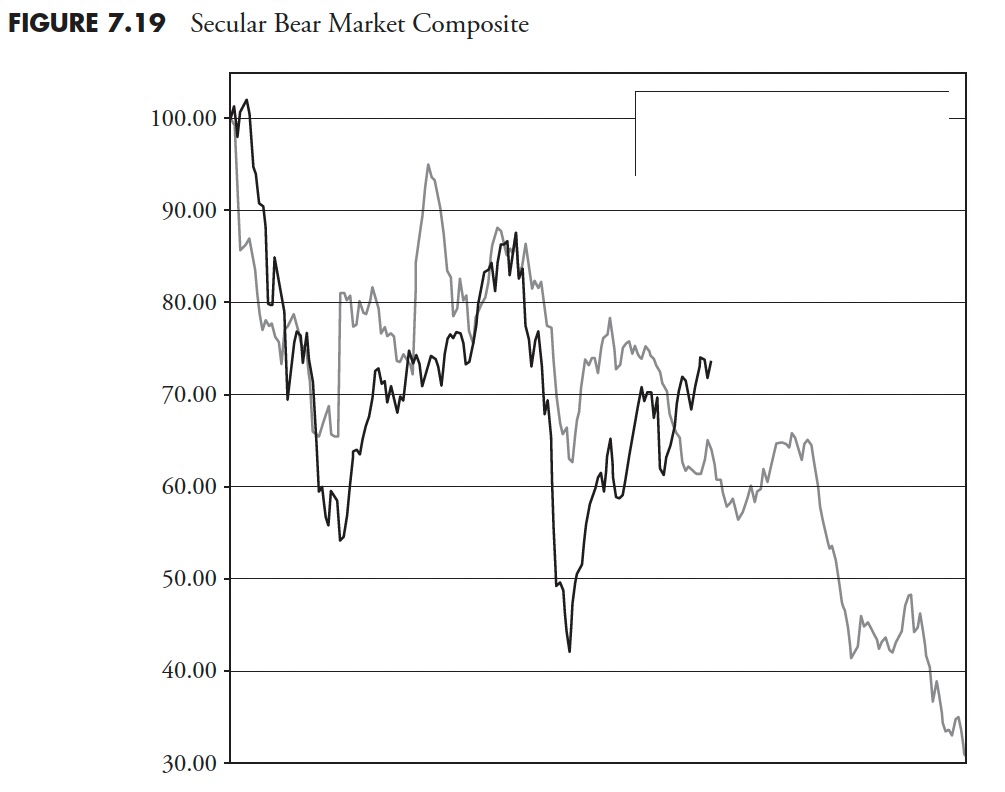

Secular Bear Market Composite

Determine 7.19 exhibits the present secular bear (daring) with the common of the earlier secular bears. Once more, this info is only for consciousness and understanding, as you can’t make funding selections with this kind of remark.

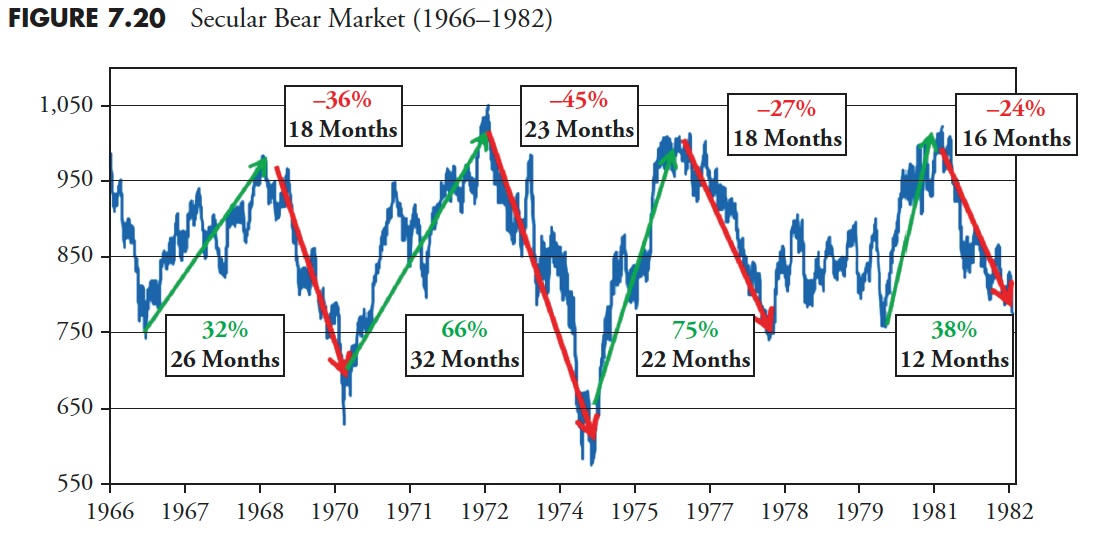

The Final Secular Bear Market (1966–1982)

Determine 7.20 exhibits that the final secular bear from 1966 to 1982 went sideways, with a variety of massive cyclical bull markets and bear markets. The message is straightforward — buy-and-hold, or index investing, didn’t go anyplace for 16 years. That is a very long time to not make any cash available in the market, particularly when you’re in your “retirement wealth accumulation” years. Nevertheless, if you happen to had a easy trend-following course of the place you could possibly seize a few of the good up strikes and keep away from a lot of the large down strikes, you’ll have come out in 1982 considerably higher off than buy-and-hold or index investing.

Discover the share strikes and the period of time that every took. When one exhibits 16 years of knowledge, typically the compressed information could make it appear to be the frequency of up and down strikes is way increased than it really is. The up strikes (cyclical bulls) averaged 23 months in size, with a median acquire of over 52 p.c. The down strikes (cyclical bears) averaged nearly 19 months with a median decline of -33 p.c. Clearly, this falls in step with frequent data that bull markets last more than bear markets, even when they’re contained in an general secular bear market.

The following chapter is actually a continuation of this chapter, delving into market valuations, market sectors, asset lessons, numerous strategies to look at returns, and the distribution of these returns.

Thanks for studying this far. I intend to publish one article on this collection each week. Cannot wait? The e-book is on the market right here.

[ad_2]

Supply hyperlink