[ad_1]

Some critical consolidation continued within the markets because the Nifty oscillated in an outlined vary earlier than closing the week with modest features. Examination of every day charts exhibits that the Nifty examined its 50-DMA once more and rebounded from that stage whereas defending that time as essential help. The buying and selling vary widened a bit. The Nifty Index oscillated in a 538-point vary over the previous 5 classes. Whereas staying largely beneath broad however outlined consolidation, the headline index closed with a internet acquire of 258.20 factors (+1.19%).

From a technical standpoint, whereas the markets proceed to consolidate, the degrees of 50-DMA is an important help. This stage at the moment stands at 21566. As of now, the markets are inside a transparent and outlined buying and selling vary of 22100-21500 ranges. Whereas the Index might proceed to oscillate backwards and forwards on this vary, it’s prone to keep devoid of any sustained directional bias. A particular pattern shall emerge provided that the Nifty is ready to convincingly take out 22100 ranges or finally ends up violating 21500 on a closing foundation. Volatility stood nonetheless; India VIX declined by 1.46% to fifteen.22 on a weekly foundation.

Monday is prone to see a quiet begin to the commerce. Whereas a flat opening is anticipated, the Nifty is prone to discover resistance at 22150 and 22300 ranges in the course of the week. The helps are available at 21800 and 21620 ranges.

The weekly RSI is 71.14. Whereas the RSI stays in a mildly overbought zone, it stays impartial and doesn’t present any divergence in opposition to the value. The weekly MACD continues to remain bullish and above its sign line.

The sample evaluation of the every day charts exhibits that the breakout that the Nifty achieved by crossing above 20800 continues to stay legitimate and in drive. Nevertheless, going by the current worth motion, the Nifty is consolidating close to its excessive level in an outlined buying and selling vary. A directional pattern shall emerge if the Nifty strikes previous 22100 or slips under 21500 ranges. Till this occurs one can pretty see the markets persevering with to consolidate.

The approaching week is prone to see the Nifty staying in an outlined vary as talked about. We’ll proceed to see some defensive pockets persevering with to do properly; apart from this, it’s also anticipated that PSU/PSE shares that have been taking a breather might even see a contemporary set of relative outperformance together with stock-specific strikes from the non-public banking area. Nevertheless, till a transparent pattern emerges, it’s strongly really useful that giant leveraged positions ought to be averted; additionally going ahead, until a powerful extension of upmove is seen, all income should be protected vigilantly at larger ranges.

Sector Evaluation for the approaching week

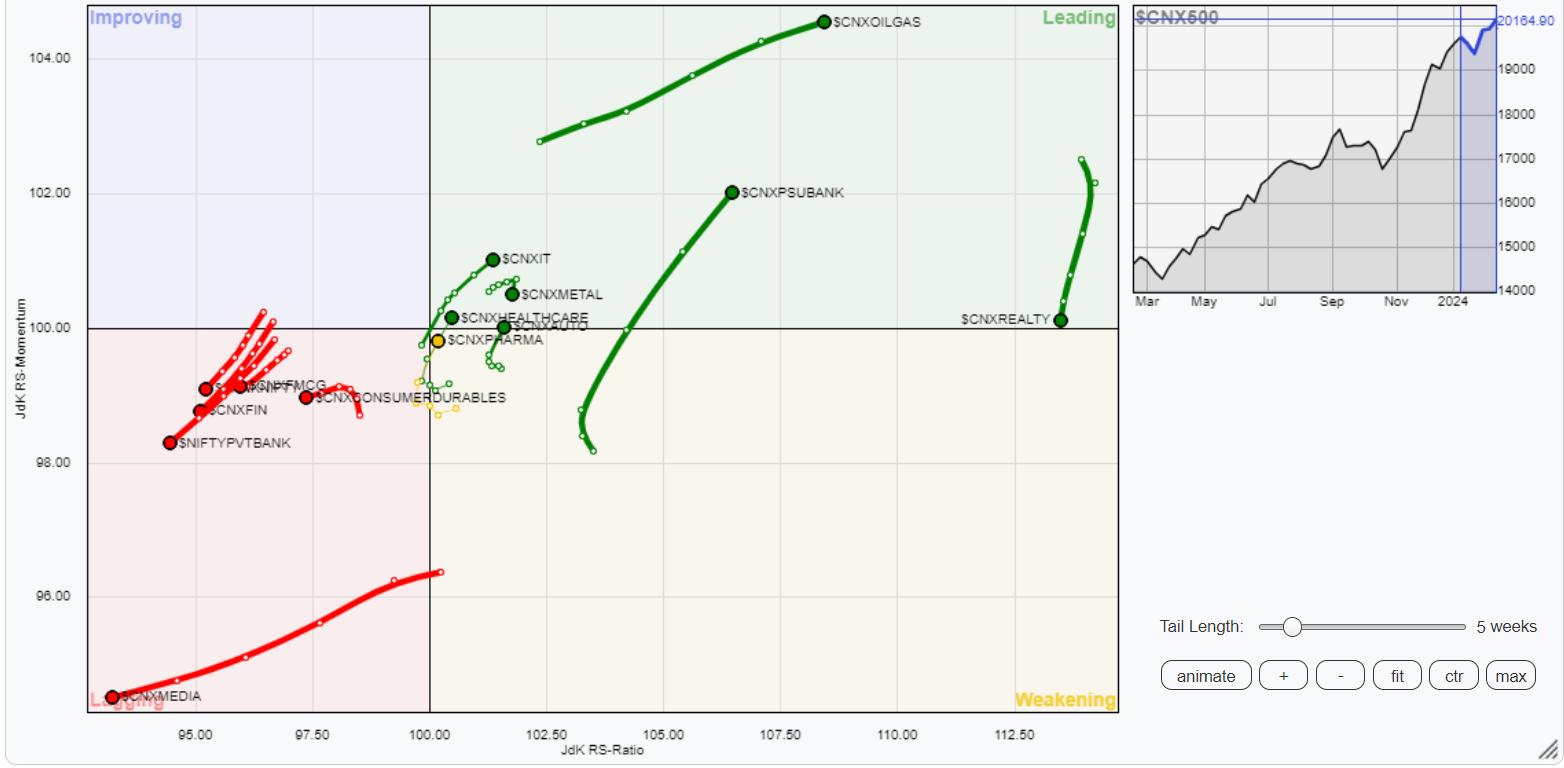

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) proceed to indicate an identical sectoral setup with no main change over the earlier week. The Nifty Power, PSE, PSU Financial institution, Infrastructure, Steel, Commodities, IT, and Realty Indices are contained in the main quadrant. Whereas the Realty Index is seen giving up on its relative momentum, this group is prone to comparatively outperform the broader Nifty 500 Index.

Whereas staying contained in the weakening quadrant, the Nifty Pharma Index is seen enhancing its relative momentum in opposition to the broader markets. In addition to this, the Nifty Midcap 100 index can be contained in the weakening quadrant.

The Nifty Media, Banknifty, and Monetary Companies index proceed to languish contained in the lagging quadrant together with the Companies Sector index.

The Nifty FMCG and Consumption Sector indices additionally stay contained in the lagging quadrant.

Essential Be aware: RRG™ charts present the relative power and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used straight as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly E-newsletter, at the moment in its 18th 12 months of publication.

Study Extra

[ad_2]

Supply hyperlink