[ad_1]

When this affected person, whereas being discharged after three days of remedy, determined to pay the invoice from his pocket moderately than look ahead to insurance coverage approval, he discovered that the invoice went up by about 27%.The hospital insisted that it was commonplace follow for the invoice to be extra if a affected person paid instantly. Too drained and sick to argue, the affected person was compelled to pay the upper quantity.

The 53-year-old affected person, who was admitted in Fortis Hospital Gurgaon for suspected meals poisoning with fever, extreme dehydration and diarrhoea on April 14, was given a twin sharing room, for which he was charged Rs 8,400 per night time, much like the room tariff of a swanky lodge in Gurgaon for a single room, besides that right here, all the things from nursing companies, and linen and laundry to admission fees and bio-medical waste disposal was charged separate from the room hire.

“They delayed informing my insurance coverage firm, although all particulars together with coverage quantity and aadhaar card got on the time of admission. That delayed the approval course of. The physician knowledgeable me on April 16 night that I’d be discharged the following day. I received a message from my insurance coverage firm at 8.07 pm on April 16 that that they had acquired the declare. If I used to be admitted at 9.30 pm on April 14, why did it take them two days to tell the insurance coverage firm? We waited the entire day until 7.30 pm on April 17 for insurance coverage approval. Lastly, bored with ready once I supplied to pay, they jacked up the invoice,” complained the affected person. Until April 27 the insurance coverage firm had not processed his reimbursement declare.

TOI’s enquiries revealed that it was certainly commonplace follow for hospitals to have discounted charges for insurance coverage corporations and better fees for sufferers who selected to pay themselves. Nonetheless, this isn’t revealed to sufferers and there’s no board put up exterior hospitals giving the distinction in charges charged to insurance coverage corporations and direct sufferers. In lots of hospitals, the distinction is about 10%. “It’s dangerous sufficient that there must be a distinction within the charges for sufferers paying instantly and for insurance coverage corporations. To cost a affected person 27% extra is obvious loot. If something, the affected person paying instantly must be charged much less because the hospital is getting the cash straight away as a substitute of getting to attend for the approval course of and a lot forwards and backwards with the insurance coverage firm asking for a number of clarifications on the invoice. Actually, in lots of smaller hospitals they cost the affected person much less in the event that they pay instantly,” defined a health care provider. A number of different medical doctors that TOI spoke to echoed his phrases.

In line with a TPA consultant Anurag Goswami, insurance coverage corporations signal MoUs with hospitals to get negotiated charges. “To start out with, they’re seen as clients not sufferers. Our clients get the negotiated charges. If the client goes instantly, the quantity will range. We get the discounted charges as a result of we deliver them enterprise/clients. These charges range for various insurance coverage corporations. Typically, if a buyer requests, they may get some low cost. Within the case of insurance coverage by means of a financial institution, if there may be any fraud you may complain to the RBI. Within the case of an insurance coverage firm, you may complain to the IRDAI. If a personal hospital does fraud, you can not go wherever as a result of they haven’t any governing authority. They know that. That’s the reason they cost particular person clients no matter they need,” stated Goswami.

In response to TOI’s queries, Fortis Hospital, Gurgaon responded: “We initially supplied hospital tariffs in accordance with our contractual obligations with Manipal Cigna insurance coverage (Mediassist – TPA) for his hospital keep. Nonetheless, resulting from a number of queries and delays in approval from the insurance coverage aspect, the affected person requested to settle the invoice and search reimbursement from the insurance coverage firm later. Consequently, as a traditional industry-wide follow, commonplace hospital tariffs have been utilized, and the contractual reductions with Manipal Cigna have been eliminated, leading to a rise within the invoice quantity.”

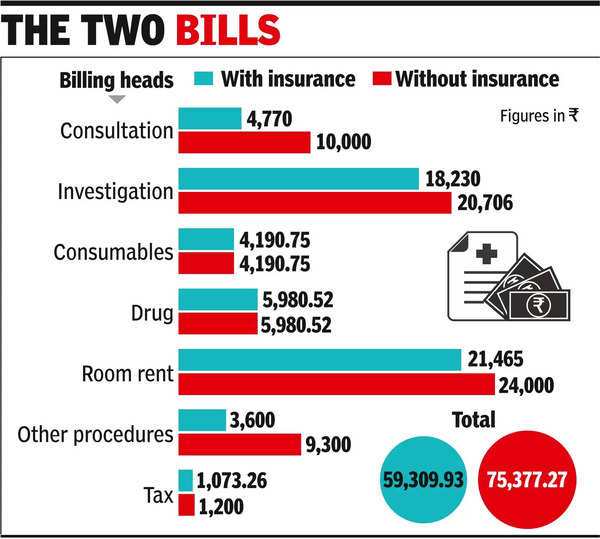

The 2 payments

| Billing heads | With insurance coverage | With out insurance coverage |

| Session | 4,770 | 10,000 |

| Investigation | 18,230 | 20,706 |

| Consumables | 4,190.75 | 4,190.75 |

| Drug | 5,980.52 | 5,980.52 |

| Room hire | 21,465 | 24,000 |

| Different procedures | 3,600 | 9,300 |

| Tax | 1,073.26 | 1,200 |

| Complete | 59,309.93 | 75,377.27 |

[ad_2]

Supply hyperlink